Should You Buy, Sell, or Rent? How to Decide What’s Right for You

Should You Buy, Sell, or Rent? How to Decide What’s Right for You

Deciding whether to buy, sell, or rent a home is a bit like standing at a crossroads with three inviting paths. Each option has its own set of rewards and challenges, and the right choice depends on your unique circumstances, goals, and the current market climate. Let’s break down what you should consider to help you confidently choose your next move.

Buying: Building Roots and Equity

Buying a home is often seen as a milestone—a way to plant roots and invest in your future. If you’re ready to settle down in one place for several years, have stable income, and are prepared for the responsibilities of ownership (think repairs, taxes, and maintenance), buying could be your best bet. Plus, every mortgage payment helps build your equity—your personal stake in your home.

- Pros: Equity growth, stability, creative freedom, potential tax benefits.

- Cons: Upfront costs, less flexibility to move, ongoing maintenance.

Selling: Cashing In and Moving On

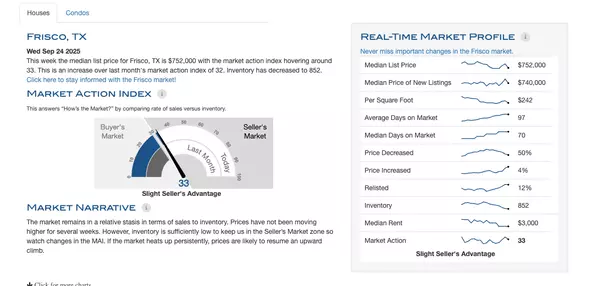

Selling might be the right choice if your current home no longer fits your needs or if you want to take advantage of a hot market. Maybe your family is growing, or perhaps you’re ready to downsize. Selling allows you to unlock the value in your home, but remember to factor in closing costs, agent commissions, and the stress of moving.

- Pros: Access to home equity, chance to upgrade or downsize, possible profit in seller’s market.

- Cons: Transaction fees, potential for stress, timing the market can be tricky.

Renting: Flexibility and Less Responsibility

Renting is perfect for those craving flexibility. If you’re new to an area, expect job changes, or just aren’t ready for the commitment of ownership, renting keeps your options open. It also means fewer responsibilities—landlords handle most repairs and maintenance. However, rent payments don’t build equity, and you might face rising rents or restrictions on customization.

- Pros: Flexibility, lower upfront costs, fewer responsibilities.

- Cons: No equity, possible rent increases, limited control over your space.

How to Decide?

Ask yourself these key questions:

- How stable is my income and lifestyle?

- Am I ready for the responsibilities of ownership?

- How long do I plan to stay in this area?

- What are my financial goals for the next few years?

There’s no universal answer—just the one that fits your life right now. Take a moment to reflect, consult with trusted advisors, and weigh your options. No matter which path you choose, you’ll be moving forward toward your goals!

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

GET MORE INFORMATION