The 50-Year Mortgage: Smart Move or Debt Trap?

🏠 The 50-Year Mortgage: Smart Move or Debt Trap?

A new kind of mortgage is making headlines — but could it cost you decades of extra payments? Here’s what you need to know before jumping in.

The idea of a 50-year mortgage sounds appealing — smaller payments, easier approval, and a way to finally buy a home in today’s market. But before you celebrate, it’s worth looking at the real cost. Realtor Troy Sage breaks down the truth behind this ultra-long loan and what it means for buyers, sellers, and the future of the housing market.

Why a 50-Year Mortgage Is Being Considered

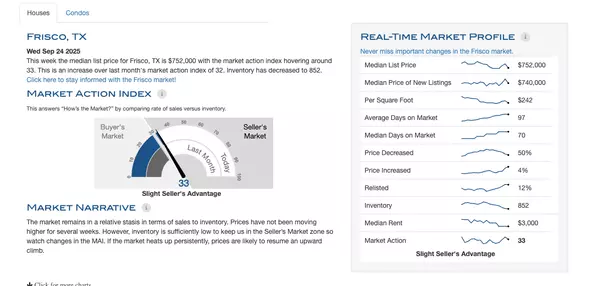

With home prices and interest rates higher than ever, many buyers feel locked out. A 50-year mortgage stretches payments over half a century, making homes look more affordable. But stretching the timeline doesn’t make the home cheaper — it just means you’ll be paying much longer.

The Potential Benefits

There are some real advantages — at least upfront:

✅ Lower Monthly Payments – Extending the loan term reduces the monthly burden, freeing up cash for other expenses.

✅ Increased Flexibility – More breathing room in your budget can make life easier in the short term.

✅ Easier Market Entry – For first-time buyers struggling to qualify, this could be their way into the market.

The Hidden Drawbacks

Now for the fine print most people skip.

🚫 Much Higher Total Interest – Over 50 years, you could pay hundreds of thousands more than a 30-year loan.

🚫 Slower

Equity Growth – You’ll build ownership in your home at a crawl, especially in the early years.

🚫 Higher Interest Rates – Lenders charge more for the longer risk period, so your savings may be smaller than you think.

🚫 Lifetime Debt – You could still be paying your mortgage during retirement — or worse, passing it on to your kids.

Could It Raise Home Prices?

When buyers suddenly “afford” more, demand increases. Without more homes being built, that could actually push prices up — making homes less affordable overall.

So, Smart Move or Debt Trap?

The 50-year mortgage might help some short-term buyers get in the door. But for most, it’s a financial slow burn that benefits the lender more than the homeowner.

Real estate success isn’t about stretching your loan — it’s about building equity strategically.

My Take — Doing Real Estate Differently

I’m all for innovation in real estate, but this one deserves caution. The key to success is understanding your financing and how it impacts your long-term goals.

If you’re considering this type of loan, let’s run the numbers together before you sign anything.

📞 Let’s Build Your Real Estate Game Plan

Don’t get trapped by long-term debt. Let’s find the smartest path to homeownership that builds real wealth, not just lower payments.

👉 Schedule a Free Strategy Call

🌐 Or visit TroySage.com to learn more about buying, selling, and investing — the Real Estate Differently way.

Categories

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

GET MORE INFORMATION